What Is Going on with Mortgage Rates?

You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data. Here’s a quick overview of what’s happening with mortgage rates and what experts say is ahead.

Economic Factors That Impact Mortgage Rates

When it comes to mortgage rates, things like the job market, the pace of inflation, consumer spending, geopolitical uncertainty, and more all have an impact. Another factor at play is the Federal Reserve (the Fed) and its decisions on monetary policy. And that’s what you may be hearing a lot about right now. Here’s why.

The Fed decided to start raising the Federal Funds Rate to try to slow down the economy (and inflation) in early 2022. That rate impacts how much it costs banks to borrow money from each other. It doesn’t determine mortgage rates, but mortgage rates do respond when this happens. And that’s when mortgage rates started to really climb.

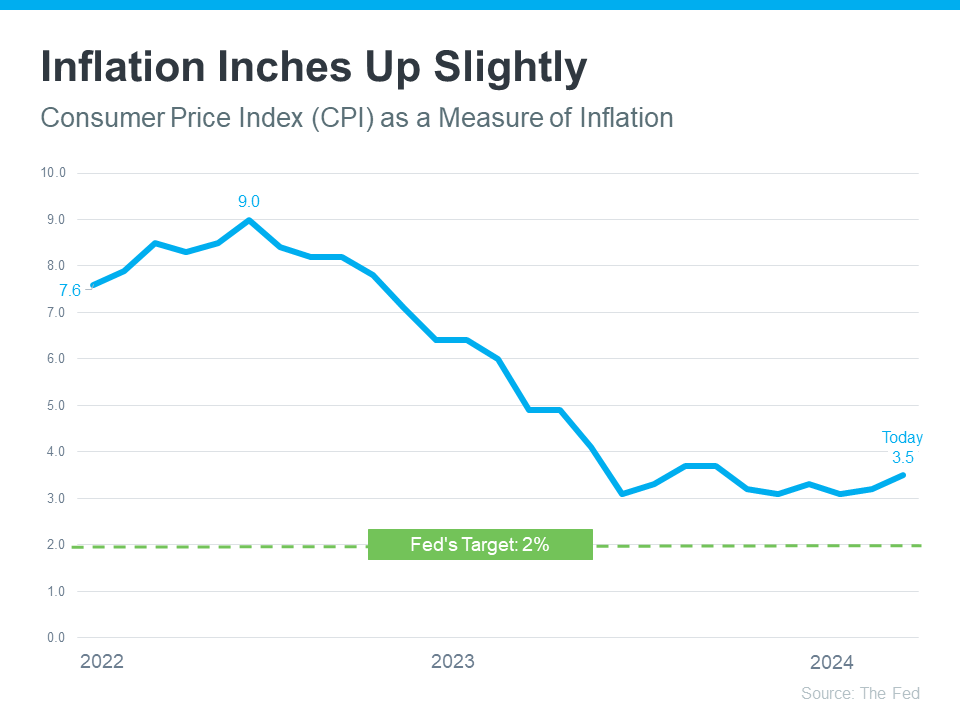

And while there’s been a ton of headway seeing inflation come down since then, it still isn’t back to where the Fed wants it to be (2%). The graph below shows inflation since the spike in early 2022, and where we are now compared to their target rate:

As the graph shows, we’re much closer to their goal of 2% inflation than we were in 2022 – but we’re not there yet. It’s even inched up a hair over the last 3 months – and that’s having an impact on the Fed’s plans. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.”

Basically, long story short, inflation and its impact on the broader economy are going to be key moving forward. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.”

When Will Mortgage Rates Come Down?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), said in response to the Federal Open Market Committee (FOMC) decision yesterday:

“The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

In the simplest sense, what this says is that mortgage rates should still come down later this year. But timing can shift as new employment and economic data come in, geopolitical uncertainty remains, and more. This is one of the reasons it’s usually not a good strategy to try to time the market. An article in Bankrate gives buyers this advice:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”

Bottom Line

If you have questions about what’s happening in the housing market and what that means for you, let’s connect.

Are you considering purchasing a home in Katy, Texas?

One of the most crucial factors to take into consideration is the current mortgage rates in the area. In today’s ever-changing real estate market, understanding how mortgage rates impact your financial future is essential.

When it comes to Katy, Texas mortgage rates, it’s important to stay informed and be strategic about your decisions. With the right knowledge and insights, you can save thousands of dollars over the life of your loan.

But how do you navigate the world of mortgage rates in Katy, Texas? Here are some tips to help you make the most of your home-buying journey:

- Research and compare rates: Before committing to a mortgage, it’s crucial to shop around and compare rates from different lenders. Even a small difference in interest rates can have a significant impact on your monthly payments and overall loan cost.

- Improve your credit score: Your credit score plays a significant role in determining the interest rate you’ll qualify for. Take steps to improve your credit score before applying for a mortgage, such as paying off debts and reviewing your credit report for any errors.

- Consider different loan options: There are various types of mortgages available, each with its own set of terms and conditions. Explore different loan options, such as fixed-rate mortgages or adjustable-rate mortgages, to find the best fit for your financial situation.

- Consult with a mortgage broker: Working with a mortgage broker can help you navigate the complex world of mortgage rates in Katy, Texas. A broker can help you find competitive rates and guide you through the application process, saving you time and money.

- Keep an eye on the market: Mortgage rates can fluctuate daily based on economic factors. Stay informed on current market trends and be prepared to lock in a rate when it’s favorable.

In conclusion, understanding Katy, Texas mortgage rates is essential for anyone looking to purchase a home in the area. By staying informed, comparing rates, and working with a knowledgeable professional, you can secure a competitive rate and save money on your mortgage. With the right approach, you can make the most of your home-buying journey in Katy, Texas.