What’s Your Katy & Houston House Worth Now? The Answer May Surprise You

Selling your Home or Buying A Home?

Call 281-717-4412 or visit callmickiec.com

If you’re a homeowner in Katy, Houston, Sugar Land, Fulshear, Cypress or Brookshire, you may be wondering just how much your house is worth in today’s real estate market. With fluctuating housing prices and market trends, it can be challenging to determine the value of your property.

In Katy, homes for sale are in high demand due to the booming economy and excellent school districts. Katy is known for its family-friendly neighborhoods and vibrant community. As a result, home values in Katy have been steadily increasing over the years, making it an attractive location for potential buyers.

Similarly, Houston homes for sale are also seeing a rise in value, especially in popular neighborhoods like the Heights, Montrose, and Midtown. The city’s diverse culture, thriving job market, and affordable cost of living are all factors contributing to the steady appreciation of home prices in Houston.

Sugar Land, known for its top-rated schools and upscale amenities, is another hot spot for homebuyers. The city’s strong economy and low crime rates make it an appealing choice for families looking to settle down. As a result, homes for sale in Sugar Land are in high demand, leading to an increase in property values.

Fulshear and Brookshire, two charming suburbs on the outskirts of Houston, are also experiencing growth in their real estate markets. With their picturesque landscapes, small-town atmosphere, and easy access to city amenities, homes for sale in Fulshear and Brookshire are attracting buyers looking for a peaceful retreat from the hustle and bustle of the city.

Overall, if you own a home in Katy, Houston, Sugar Land, Fulshear, or Brookshire, chances are it’s worth more now than when you first purchased it. To get an accurate estimate of your property’s value, consider consulting with a real estate agent or using online tools to assess market trends and comparable sales in your area. With the right information, you can make informed decisions about selling or investing in your property for the future.

Let’s talk about something you might not check nearly as often as your bank account – and that’s how much your home is worth. But when it comes to your financial situation, it’s an important thing to remember. When’s the last time you had a professional show you the value of your home?

Think about it. For most people, your house is probably the biggest asset you have. And if you’ve owned your home for a few years (or longer), chances are it’s been quietly building wealth for you in the background. And honestly? You might be surprised by just how much.

What Is Home Equity?

This wealth you may not even realize you have comes in the form of home equity. Home equity is the difference between what your house is worth and what you still owe on your mortgage. It grows over time as home values rise and as you pay down your mortgage each month. Here’s an example to help you really understand how this works.

Let’s say your house is now worth $500,000, and you have $200,000 left to pay off on your loan. That means you have $300,000 in equity. And most homeowners are sitting on some pretty significant equity right now.

According to Cotality (formerly CoreLogic), the average homeowner with a mortgage has about $311,000 in equity.

Why You Probably Have More Than You Think

Here are the two main reasons homeowners like you have record amounts of equity right now:

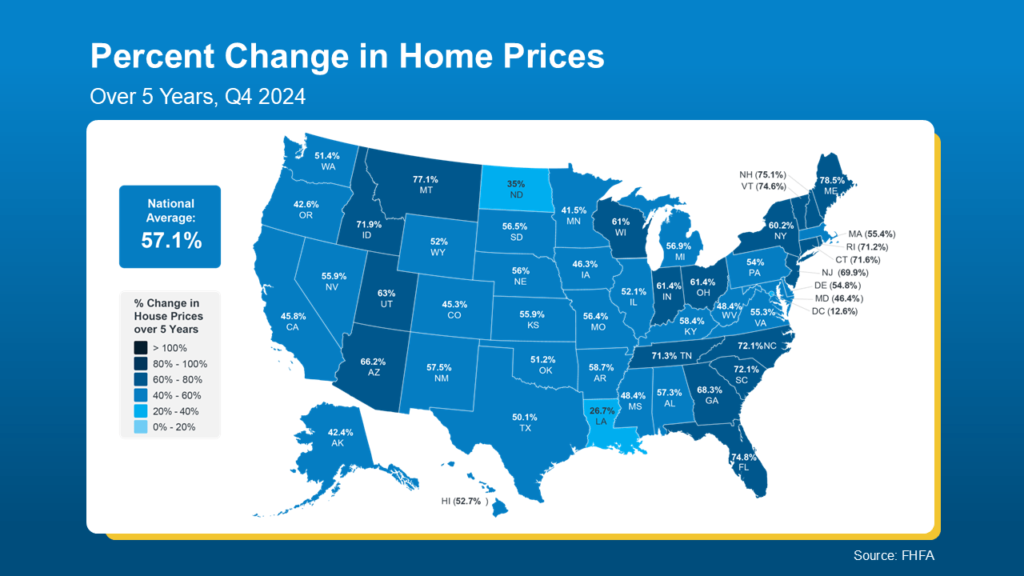

1. Significant Home Price Growth. According to the Federal Housing Finance Agency (FHFA),home prices have jumped by more than 57% nationwide over the last five years (see map below):

And if you purchased your home a few years ago (or more), this means your house is likely worth much more now than when you first bought it, thanks to how much prices have climbed lately.

2. People Are Living in Their Homes Longer. Data from the National Association of Realtors (NAR), shows the average homeowner stays in their home for about 10 years now (see graph below):

That’s longer than it used to be. And over that decade? You’ve built equity just by making your mortgage payments and riding the wave of rising home values.

So, if you’re one of those people who’s been in their home for that long, here’s how much the behind-the-scenes price growth has helped you out. According to NAR:

“Over the past decade, the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.”?

What Could You Actually Do with That Equity?

Remember, your house might be your biggest financial asset – and, if you’re smart about how you leverage your equity, it could open up some exciting opportunities for your future.

- Use it to help buy your next home. Your equity could help you cover the down payment on your next home. In some cases, it might even mean you can buy your next house in all cash.

- Renovate your current house to better suit your life now. And, if you’re strategic about your projects, they could add even more value to your home if you do sell later on.

- Start the business you’ve always dreamed of. Your equity could be exactly what you need for startup costs, equipment, or marketing. And that could help increase your earning potential, so you’re getting yet another financial boost.

Selling your Home or Buying A Home?

Call 281-717-4412 or visit callmickiec.com

Bottom Line

Chances are, your house is worth a lot more than you realize. Whether you’re thinking about selling, upgrading, or simply want to understand your options, your equity isn’t just a number. It’s a tool.

If you sold your house and had significant equity to work with, what would you do with it? Let’s figure out how to turn your home’s value into your next big move.